- ESG RE

- About us

- Certified Asset Design

- Icon Platform

- System Origin

- Fund

- Design

- Asset Mgmt.

- Market

- Portfolio

- Job openings

- Resources

- Contact

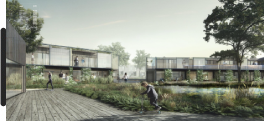

ESG RE Asset Management is where long-term value is realized and sustained. Leveraging the intelligence and structure delivered through our Fund, Design and Marketing verticals, we ensure every asset – new or existing – operates at peak performance throughout its lifecycle. By connecting pre-development, cap improvement and financial modeling with real-time building operations, we go beyond sustainable asset management, reduce lifetime operational costs, and seamlessly align each asset’s value with long-term capital and performance goals. With seamless continuity from early-stage to post-occupancy, our verticals simplify ESG execution, strengthen operational control and future-proof both the asset and its investment profile.

Built on the foundations of our Fund and Design verticals, ESG RE AM ensures every asset we touch is conditioned for long-term operational excellence. From construction through hold to exit, we embed renowned, data-backed asset management principles that drive profitability, compliance, and cap alignment throughout the asset lifecycle.

Whether you’re managing a single core-plus asset or a multi-market portfolio, ESG RE Asset Management guarantees your building doesn’t just perform – it outperforms. This is operational ESG RE AM excellence…built for returns, resilience and results beyond market standards.

ESG-Rated

Sustainable Building & Real Estate

ESG-Rated

Sustainable Building & Real Estate