- ESG RE

- About us

- Certified Asset Design

- Icon Platform

- System Origin

- Fund

- Design

- Asset Mgmt.

- Market

- Portfolio

- Job openings

- Resources

- Contact

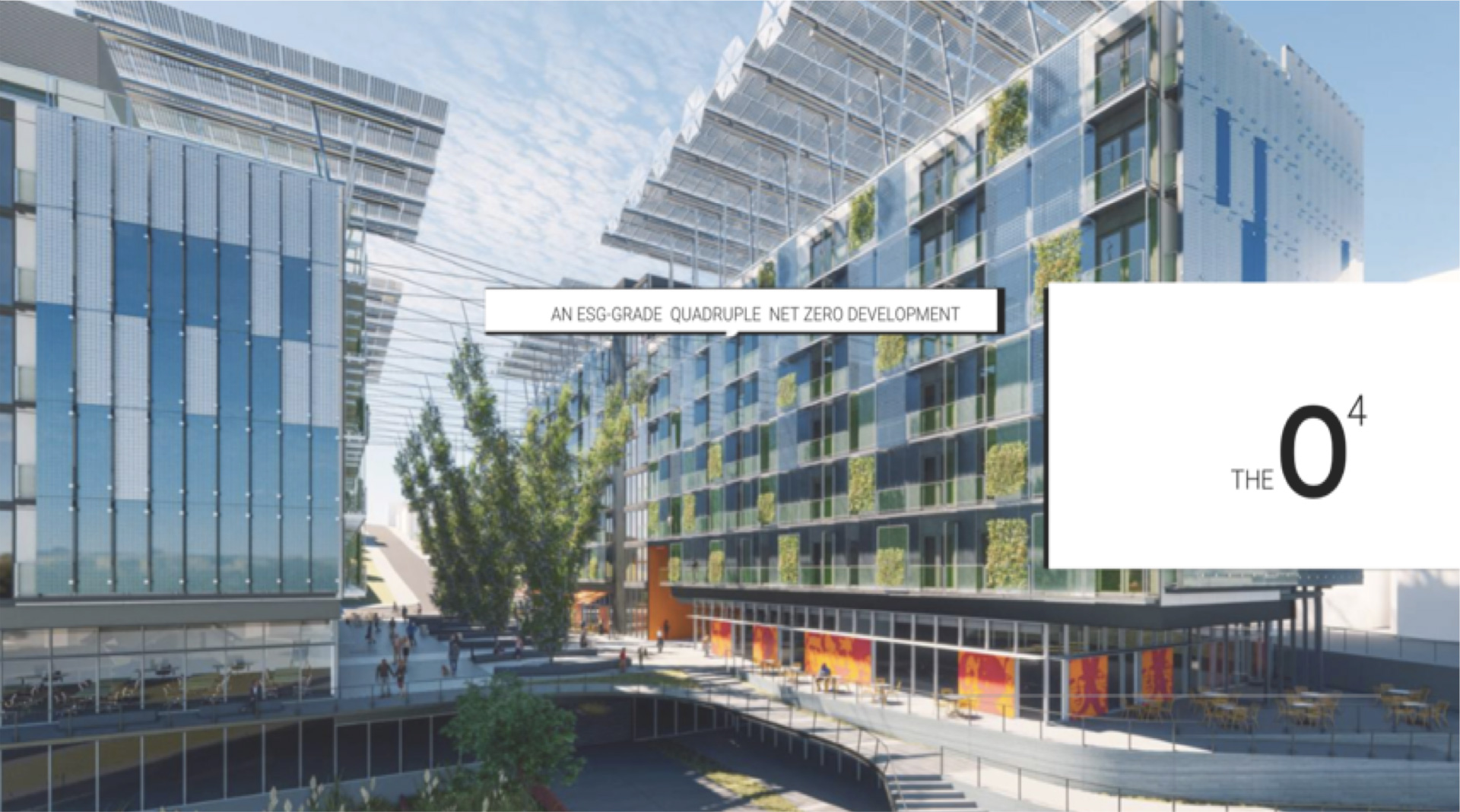

The ESG RE Fund is a performance-driven debt solution designed to deliver institutional-quality capital, while pricing in the true value of a borrower’s sustainability commitment. Whether you're financing a new development, repositioning a traditional asset, or optimizing an existing building, our capital intelligently rewards sustainability performance without compromising speed, scale, strategy or structure.

Whether you’re leading the way in green building or just starting to explore sustainability as a value driver, our ESG RE Fund unlocks measurable gains in financial, environmental, social and governance performance…from the ground-up to fully stabilized assets.

ESG-Rated

Sustainable Building & Real Estate

Backed by ESG RE’s design and asset management verticals, the fund ensures each financed asset is fully optimized across sustainability and economic KPIs. Our debt pricing model seamlessly integrates your sustainability commitment. The stronger the environmental, social, and governance profile of your asset, the more favorable your financial, cost of capital and investment outcome. We underwrite ESG as a performance driver, not just a risk mitigant. With built-in design support, post-close asset management and independent certification our capital does more than fund your deal – it strengthens your asset, your position and your outcomes.

ESG-Rated

Sustainable Building & Real Estate

Our fund is designed for institutional users who see ESG as an strategic advantage, not just a compliance checkbox. Whether you’re pursuing LEED Platinum, or a conventional player, owner/operator exploring how sustainability can drive better results – we meet you where you are:

For sustainability-minded developers: We underwrite ESG as a source of better performance, offering better pricing, lower risk, and increased asset value.

For traditional sponsors: We leverage your unique positioning to help you costeff-ectively implement high-impact ESG performance that enhance your investment case without deviating from your strategy or comprising returns.

ESG-Rated

Sustainable Building & Real Estate

The ESG RE Fund equity platform captures the full upside of sustainable real estate – targeting mixed use, multi-family, and commercial projects with automated material ESG integrated and outsized financial returns. We don’t greenwash, we build smarter, more resilient, high-performing assets that deliver results. If you’re an equity partner, family office, or institutional co-investor seeking to align elite financial returns with forward-looking real estate strategy – The ESG RE Fund offers a differentiated edge. Let’s unlock sustainable alpha, together.

ESG-Rated

Sustainable Building & Real Estate

Each asset undergoes a full-stack ESG transformation – zero carbon operations, supply chain measurement, health and safety, climate resilience, embodied carbon metrics and verified ESG ratings. Backed by our verticals, the ability to incorporate sustainable performance from planning throughout construction and occupancy is seamless, affordable and unmatched throughout the asset’s whole lifecycle.

Institutional returns with ESG Alpha: Our equity thesis centers on material financial value creation through targeted ESG interventions.

High-performance ESG Execution: We invest in assets where sustainability integration materially improves performance, not just optics. Each project undergoes a full-stack upgrade.

ESG-Rated

Sustainable Building & Real Estate

ESG-Rated

Sustainable Building & Real Estate