- ESG RE

- About us

- Certified Asset Design

- Icon Platform

- System Origin

- Fund

- Design

- Asset Mgmt.

- Market

- Portfolio

- Job openings

- Resources

- Contact

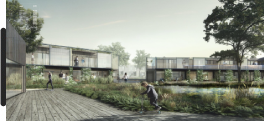

At ESG RE, design is not a soft feature – it’s building performance that translates directly into a financial engine. Our Design vertical delivers high performance ESG architecture that’s cost-effective and unmatched in sustainable building quality that decisively improves value at every layer of the capital stacks. From net zero, passive principles, and carbon smart materials to social performance, measured health and safety, commissioning and much more, each project is planned and built to outperform – financially, sustainably and architecturally.

ESG RE Design isn’t aesthetic fluff or engineering jargon. It’s a strategic tool that drives asset-level returns and portfolio-wide performance. Our method enhances - not replaces – architecture and engineering. ESG RE Design overlays smart, data-driven sustainability principles that simplify high performance building execution without compromising its quality, improves capital efficiency, streamlines the commissioning process and unlocks sustainable building alpha.

Whether you’re planning a ground-up development, repositioning a stabilized asset, or managing a national portfolio, our design method builds in what matters most: resilience, performance, and return – automatically

ESG-Rated

Sustainable Building & Real Estate

ESG-Rated

Sustainable Building & Real Estate